Gold IRA Rollover: Secure Your Retired Life with Priceless Steels

In today's unsteady economic situation, maintaining your retirement savings risk-free is vital. A Gold IRA Rollover is a clever way to spread out your financial investments and secure against market ups and downs. IRAxp aids you with this procedure, making sure you can secure your future with gold and various other rare-earth elements.

When you relocate your retirement funds into a self-directed Gold IRA, you utilize gold and various other rare-earth elements to secure your riches. This step is tax-smart. It allows you invest in genuine gold, which can defend against rising cost of living and market adjustments.

Safeguarding Your Financial Future with Gold

With the economy unpredictable and markets shaky, safeguarding your economic future is key. A clever step is to assume concerning a gold IRA rollover. Gold is referred to as a solid way to deal with inflation and shield wealth.

Including rare-earth elements IRA to your retired life cost savings can spread out your investments. This can reduce the risks linked to regular monetary devices. It helps maintain your cost savings secure throughout difficult economic times.

A gold IRA rollover also includes tax obligation advantages. Relocating cash from your existing IRA or 401( k) to a gold IRA allows you expand your wide range while keeping control of your retirement funds.

As even more individuals all over the world want gold, your financial investment could expand. This can make your monetary future much more stable and your financial investments more differed. Consider a gold IRA rollover to protect your wealth for the future.

Tax obligation Advantages of a Gold IRA Rollover

Investing in a gold IRA offers huge tax advantages. When you move funds from a 401( k) or standard IRA to a gold IRA, it's tax-free. This lets you place the sum total into rare-earth elements without shedding cash to tax obligations.

A gold IRA rollover is terrific for your lasting wide range. It lets you postpone tax obligations, which can grow your retired life financial savings gradually. This indicates a stronger portfolio for your retirement years.

Gold IRAs likewise have much more tax obligation rewards than normal retirement accounts. The value of your gold grows without being tired right now. When you take money out, it's tired at a lower rate. This can save you a whole lot of money and keep even more of your savings for later.

Looking into the tax benefits of a gold IRA rollover is clever for safeguarding your monetary future. It's a way to grow your retired life cost savings with the special benefits of valuable steels. By spreading out your retired life cost savings, you can safeguard your wealth and purpose for more growth with time.

The Benefits of Self-Directed Gold IRAs

Buying a self-directed gold IRA lets you regulate your retired life savings. You can include rare-earth elements like gold, silver, platinum, and palladium to your profile. This can shield your riches from market ups and downs.

With a self-directed gold IRA, you have a lot more control over your investments. You pick the precious steels that fit your financial objectives and just how much threat you can take. By doing this, you choose that assist protect your wealth gradually.

Including a self-directed gold IRA to your retirement cost savings can decrease threats. Rare-earth elements frequently maintain their value when the ira secured by gold economic situation is unsteady. Adding gold, silver, and other metals to your IRA makes your investments stronger and a lot more secure.

Simplifying the Gold IRA Rollover Process

Moving your retired life cost savings to a gold IRA rollover can appear difficult, but IRAxp makes it very easy. Their team will certainly aid you at every action, from opening your IRA to buying rare-earth elements. They deal with relied on IRA custodians to keep your assets safe and insured, offering you comfort.

First, you established up your account with IRAxp. Their experts will certainly assist you with the paperwork and deal with all the information, making it smooth. After that, they'll aid you money your account, whether it's from one more IRA, 401( k), or a direct contribution.

Once your account is moneyed, you can choose from a variety of IRS-approved steels. IRAxp's group will certainly direct you in selecting the appropriate steels for your economic goals and take the chance of level.

IRAxp's assistance is always there for you throughout the entire process. Their wonderful customer care and deep knowledge in the industry make the gold IRA rollover simple and carefree.

In today's unpredictable economic situation, a gold IRA rollover can be a solid guard against market ups and downs. Including priceless metals like gold to your retired life savings can safeguard your money from stock exchange changes. Gold has actually always maintained its value well, even when the economic climate is unstable, making it a risk-free area for your cash.

Putting money right into a gold IRA rollover can make you feel much more secure, also when the economy is unpredictable. Gold is seen as a fantastic means to deal with inflation, keeping your money's worth steady as prices rise. This is specifically useful for people near retirement or already retired, who bother with losing financial savings to market swings.

A gold IRA rollover also adds variety to your investment mix. Mixing gold with stocks and bonds decreases your danger and can make your retirement financial savings more stable with time.

So, a gold IRA rollover is a clever relocation for maintaining your wide range safe and preparation for the future. Utilizing gold's unique qualities, you can protect your retirement cost savings and really feel even more secure with a diverse financial investment mix.

IRA-Eligible Precious Metals for Your Portfolio

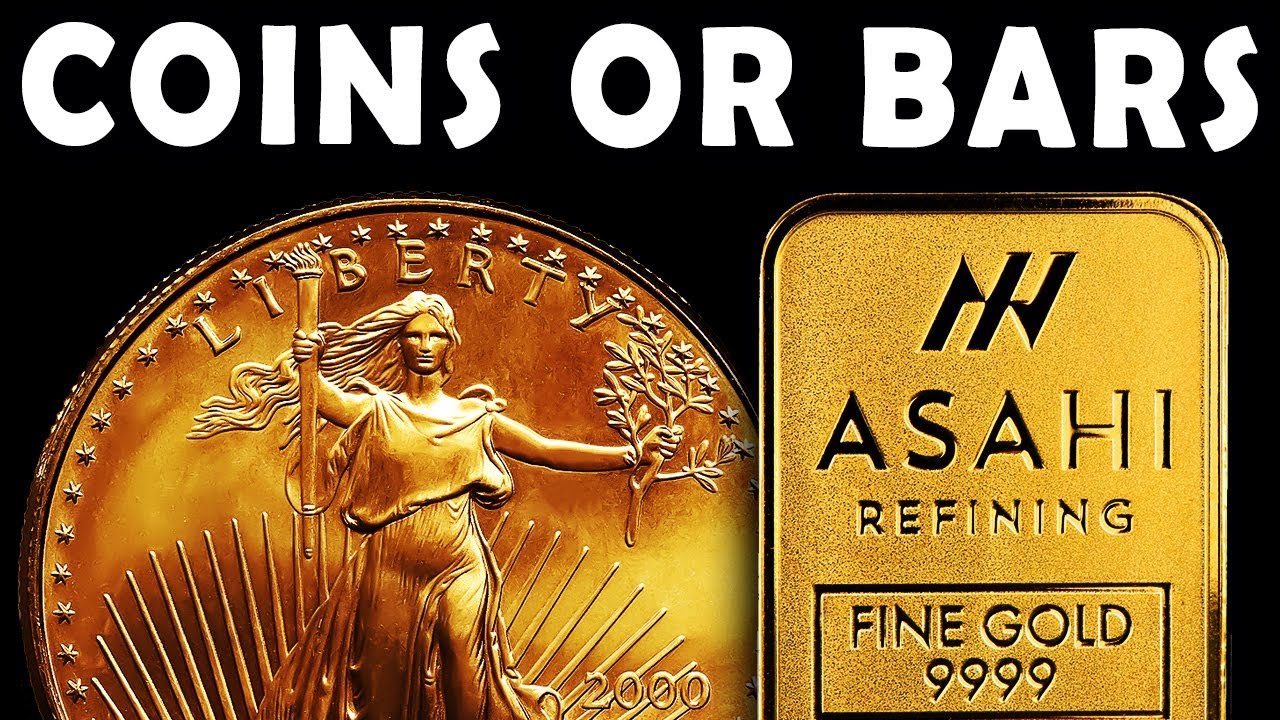

Investing in rare-earth elements via a Gold IRA brings stability and safety and security to your retirement cost savings. At IRAxp, we provide a vast array of IRA-eligible metals. These include gold, silver, platinum, and palladium in the form of coins, bars, and rounds. These steels can conveniently be contributed to your self-directed IRA, making your profile extra diverse and safeguarding it from market ups and downs.

Whether you enjoy the timeless appeal of gold, the flexibility of silver, or the individuality of platinum and palladium, our IRA-eligible rare-earth elements are a fantastic choice for retired life preparation. We make sure each metal fulfills the IRS's high requirements. This gives you assurance when spending in bullion coins and bars for your future.

Adding IRA-eligible precious metals to your profile can reduce your danger and aid you expand your wealth in time. Our experts at IRAxp are prepared to help you add these beneficial properties to your portfolio diversity strategy. Begin using priceless metals to safeguard your retired life with confidence.